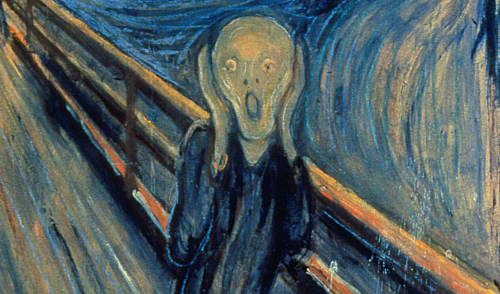

An actual photo of me overthinking a terrible investment.

“Success is stumbling from failure to failure with no loss of enthusiasm.” Winston Churchill

30 years of scars and ∞ WTFs. We all screw up; I just do it more often, and I wear those scars like medals. Take DealBench, for example. I snagged it out of the ashes of Enron’s colossal corporate flameout. Then, I brilliantly drove it straight into the dirt. But here’s the kicker: those epic fails were my crash course in the do’s and don’ts of early-stage investing.

Like my daughter, I learn best the hard way. I’ve often thought how many Harvard Business School tuitions my screw-ups could’ve covered (and please, DON’T tell my wife!). But here’s the silver lining: each screw-up has honed my investing skills. As an investor, you’ll wish for do-overs, but you don’t get them. You just learn and keep moving forward.

Key Takeaways:

- Portfolio Effect: Set your portfolio budget, timelines and thesis. Strictly adhering to those rules will optimize your returns.

- Decisioning: Make slow and deliberate decisions. I abhor the sentence, “Patience is a virtue.” In this case, it’s spot on. UHG.

- Learn From Mistakes: I’ve said this 100s of times, make better mistakes tomorrow.

- BONUS for Former founders: You can’t fix everything. STOP wasting time trying.

Select DealBench Mistakes that Hurt (Based on Frequency of Scars)

Understand that by no stretch of the imagination do I offer this as an exhaustive list of every mistake to avoid in early stage investing. Even now, I think I’ve seen it all. Nope. Early-stage investing is a roller-coaster of infinite WTFs!

- Predetermine and stay consistent with your investment amounts. I’m okay with over or underweighting within reason (my new rule is 3x over or 50% under). Set your rules, follow them, and use a regular cadence to diversify your investments over time. I aim for 10-12 deals per year.

Quality Over Quantity:

- Focus on the quality of your investment funnel and rigorous due diligence rather than the quantity of investments. When you do this, the rest naturally follows. Remember, you’re not a kid in a candy store; you’re selecting future winners.

Hype vs. Substance:

-

“Don’t Believe the Hype” isn’t just a Public Enemy song; it’s great investing advice. Just because Khosla, Andreessen Horowitz, or Sequoia is investing doesn’t mean you should. Most likely, you’re only going to get their SHIT deals anyway. See also, FOMO.

- FOMO should never trump DYOR (Do Your Own Research). Don’t get blown into a deal because everyone else is or because the founder is pushing you to close fast. Invest with a clear, well-informed head. “Take Your Time (Do It Right)” old song

- Ask unbiased questions. Don’t fit the answer into what you want to hear or what you want the answer to be.

-

Step two: Ask better questions. Rinse and repeat.

-

Invest in people, not just business plans. I’ve made this mistake too many times. A killer business plan is great, but it’s the people who execute it that matter. Back passionate, driven founders with the skills to navigate the chaos.*

Founder Commitment:

- STAY AWAY from big salaries and part-timers. These are not serious founders.*

Due diligence:

- Trust but verify. Make slow, deliberate decisions. DO NOT ignore red flags.

Red flags.

- I have a well-worn pair of rose-colored glasses. Don’t wear rose-colored glasses; throw them away. If the story doesn’t make sense, if the numbers don’t add up, if the team lacks experience, or if the product feels like yesterday’s news, pass on it. A bad feeling can save you a boatload of cash.

Follow-on Investments:

- Don’t throw good money after bad. Treat every follow-on investment as if it’s your first investment in the company. My main mistake here has been confusing early sales with PMF.

“Prediction is very difficult, especially if it’s about the future.” Niels Bohr

Remember, these are just a few of my legendary mistakes on the highlight reel of my journey. Every company out there deserves its shot. Sure, we’re here to support these founders, but let’s not confuse philanthropy with business. Make no mistake, we’re here for the DPI. DPI isn’t just about helping; it’s about helping you help a hell of a lot more founders! (DPI= Cumulative Distributions / Paid In Capital)

*I’ll write a post fully focused on the importance of the founder and founding team.

Disclaimer: This analysis is for entertainment purposes only and does not constitute financial advice.

About the Artwork:

- Ed Ruscha painted “OOF” in 1962. Oil on canvas. 5’11” x 5’7″.

- Edvard Munch painted the first “Skrik” aka “The Scream” in 1893. Oil, tempera, pastel and crayon on cardboard. I used some bastardized version of the painting to fit size requirements and color scheme. Interesting read about the painting(s) here.